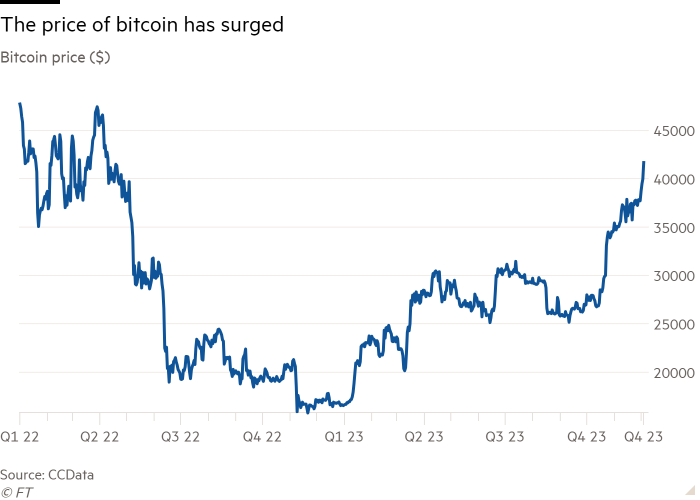

Bitcoin surged to its highest price in nearly 20 months while gold hit an all-time peak on Monday, as frenzied investor speculation that interest rates will fall next year rippled through assets across the globe.

The cryptocurrency soared to more than $42,000 on Monday, also boosted by optimism that the toughest regulatory punishments for the industry have passed. It later fell back to $41,662, up 7.4 per cent on the previous day.

Gold rallied as much as 3 per cent to $2,135 per troy ounce on Monday, a new record, before slipping to $2,025 per troy ounce, according to LSEG data.

The moves follow a recent rush into stocks and bonds, fuelled by growing expectations that the US Federal Reserve will soon cut borrowing costs despite chair Jay Powell’s assertion on Friday that it was “premature” to conclude that the central bank has won its battle with inflation.

“You look at bitcoin and gold and you see a very similar kind of evolution,” said Luca Paolini, chief strategist at Pictet Asset Management. “All the asset classes that tend to do well when the Fed cuts rates aggressively are doing well.”

Traders are now betting the first rate reduction could come as soon as March after a sharp decline in government and corporate borrowing costs as US bond markets enjoyed their biggest monthly rally in nearly four decades in November.

Lower yields on ultra-safe US Treasury debt have made other assets relatively more attractive to investors. The S&P 500 index closed at its highest level since March 2022 last week, although it was down 0.6 per cent midway through Monday’s session. Recent US economic data has been resilient even while inflation has fallen, further boosting risky assets such as stocks.

Max Kettner, chief multi-asset strategist at HSBC, said markets were in the grip of an “everyone-is-happy-Goldilocks rally” across “virtually all asset classes”.

Traders said the momentum to buy bitcoin, whose value has climbed more than a fifth in the past month, was also driven by growing interest among investors after the closure of two of the most high-profile criminal cases that had hung over the market for the past year.

Last month the US successfully prosecuted Sam Bankman-Fried, former chief executive of FTX, and Binance, the world’s largest crypto exchange. Bankman-Fried was convicted of fraud and Binance paid $4.3bn in penalties after pleading guilty to criminal charges related to money laundering and financial sanctions breaches.

But despite many traders’ fears, US authorities did not shut down Binance. The cryptocurrency exchange continues to face a separate lawsuit from the Securities and Exchange Commission for allegedly violating securities laws.

“The message from many institutional investors was that they needed two things before looking at the space again: closure on FTX and clarity around Binance,” said Henri Arslanian, co-founder of Nine Blocks Management, a crypto hedge fund manager based in Dubai.

Ethereum, the second most actively traded cryptocurrency, also rose 8.3 per cent to $2,260 on Monday, its highest level since May last year.

Investors are also hopeful the SEC will approve an exchange traded fund for bitcoin in coming weeks. The regulator has refused for a decade to approve spot bitcoin ETFs, stock market funds that invest directly in the cryptocurrency.

Some of Wall Street’s largest investors, including BlackRock and Franklin Templeton, have joined companies such as VanEck and WisdomTree in submitting filings with the SEC.

The market has long viewed spot bitcoin ETFs as a way to wrest control of digital assets from scandal-ridden crypto groups in favour of mainstream businesses such as BlackRock.

United Arab Emirates Dirham Exchange Rate

United Arab Emirates Dirham Exchange Rate