WASHINGTON (news agencies) — President-elect Donald Trump campaigned on the promise that his policies would reduce high borrowing costs and lighten the financial burden on American households.

But what if, as many economists expect, interest rates remain elevated, well above their pre-pandemic lows?

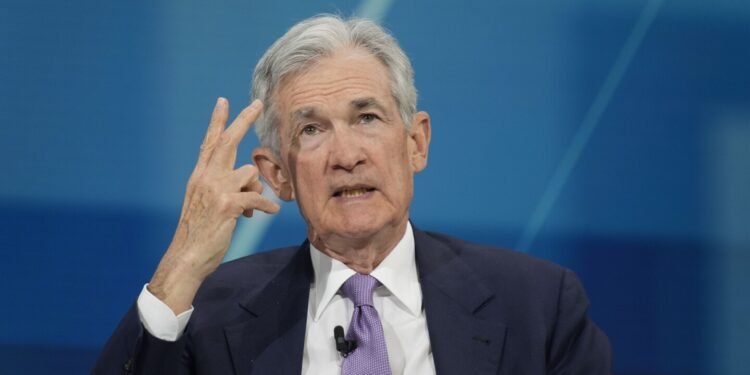

Trump could point a finger at the Federal Reserve, and in particular at its chair, Jerome Powell, whom Trump himself nominated to lead the Fed. During his first term, Trump repeatedly and publicly ridiculed the Powell Fed, complaining that it kept interest rates too high. Trump’s attacks on the Fed raised widespread concern about political interference in the Fed’s policymaking.

On Wednesday, Powell emphasized the importance of the Fed’s independence: “That gives us the ability to make decisions for the benefit of all Americans at all times, not for any particular political party or political outcome.”

Political clashes might be inevitable in the next four years. Trump’s proposals to cut taxes and impose steep and widespread tariffs are a recipe for high inflation in an economy operating at close to full capacity. And if inflation were to reaccelerate, the Fed would need to keep interest rates high.

Because Powell won’t necessarily cut rates as much as Trump will want. And even if Powell reduces the Fed’s benchmark rate, Trump’s own policies could keep other borrowing costs — like mortgage rates — elevated.

The sharply higher tariffs that Trump has vowed to impose could worsen inflation. And if tax cuts on things like tips and overtime pay — another Trump promise — quickened economic growth, that, too, could fan inflationary pressures. The Fed would likely respond by slowing or stopping its rate cuts, thereby thwarting Trump’s promises of lower borrowing rates. The central bank might even raise rates if inflation worsened.

“The risk of conflict between the Trump administration and the Fed is very high,” Olivier Blanchard, former top economist at the International Monetary Fund, said recently. If the Fed hikes rates, “it will stand in the way of what the Trump administration wants.”

Yes, but with the economy sturdier than expected, the Fed’s policymakers may cut rates only a few more times — fewer than had been anticipated just a month or two ago.

And those rate cuts might not reduce borrowing costs for consumers and businesses very much. The Fed’s key short-term rate can influence rates for credit cards, small businesses and some other loans. But it has no direct control over longer-term interest rates. These include the yield on the 10-year Treasury note, which affects mortgage rates. The 10-year Treasury yield is shaped by investors’ expectations of future inflation, economic growth and interest rates as well as by supply and demand for Treasuries.

An example occurred this year. The 10-year yield fell in late summer in anticipation of a Fed rate cut. Yet once the first rate cut occurred on Sept. 18, longer term rates didn’t fall. Instead, they began to rise again, partly in anticipation of faster economic growth.

Trump has also proposed a variety of tax cuts that could swell the deficit. Rates on Treasury securities might then have to rise to attract enough investors to buy the new debt.

“I honestly don’t think the Fed has a lot of control over the 10-year rate, which is probably the most important for mortgages,” said Kent Smetters, an economist and faculty director at the Penn Wharton Budget Model. “Deficits are going to play a much bigger role in that regard.”

Occasional or rare criticism of the Fed chair isn’t necessarily a problem for the economy, so long as the central bank continues to set policy as it sees fit.

But persistent attacks would tend to undermine the Fed’s political independence, which is critically important to keeping inflation in check. To fight inflation, a central bank often must take steps that can be highly unpopular, notably by raising interest rates to slow borrowing and spending.

Political leaders have typically wanted central banks to do the opposite: Keep rates low to support the economy and the job market, especially before an election. Research has found that countries with independent central banks generally enjoy lower inflation.

Even if Trump doesn’t technically force the Fed to do anything, his persistent criticism could still cause problems. If markets, economists and business leaders no longer think the Fed is operating independently and instead is being pushed around by the president, they’ll lose confidence in the Fed’s ability to control inflation.

And once consumers and businesses anticipate higher inflation, they usually act in ways that fuel higher prices — accelerating their purchases, for example, before prices rise further, or raising their own prices if they expect their expenses to increase.

“The markets need to feel confident that the Fed is responding to the data, not to political pressure,” said Scott Alvarez, a former general counsel at the Fed.

He can try, but it would likely lead to a prolonged legal battle that could even end up at the Supreme Court. At a November news conference, Powell made clear that he believes the president doesn’t have legal authority to do so.

United Arab Emirates Dirham Exchange Rate

United Arab Emirates Dirham Exchange Rate